The Shipbuilding Situation

THe Shipbuilding Situation

The state of the US Fleet and shipbuilding on the Lakes

As featured in Shipwatcher News Freighters issues 78 and 79, 2025.

The shipbuilding situation

The state of the US Fleet and shipbuilding on the Lakes

By Brendan Falkowski

This article is the first in a series focusing on the current state of the Great Lakes shipping industry as we look to a future that is sustainable for both commerce and the environment.

Just over the last few months shipbuilding has gone from a forgotten industry in America to routinely making front page headlines. The current world climate has raised alarms across the globe for renewed investments in navies and merchant fleets as world powers compete for dominance of the seas. Even with this renewed interest in maritime, the Great Lakes still go largely under the radar, something this corner of the industry knows far too well. The spotlight only seems to find the Great Lakes maritime industry when things go wrong, and almost never highlight the industry’s large role in the US economy and defense supply chain. Congressional reports cite that over 90% of the iron ore consumed by America’s steelmaking industry is mined in the Great Lakes region and shipped through the holds of Great Lakes ships. The majority of American manufacturing is tied to the ability of raw materials to flow through the Great Lakes-Seaway system. Iron ore is just one of many other cargoes that support power generation, construction, food supply chains, and more throughout the region and even the world. As the national spotlight looks to the rest of US maritime when it comes to shipbuilding, let’s take a closer look at the current situation on the Great Lakes.

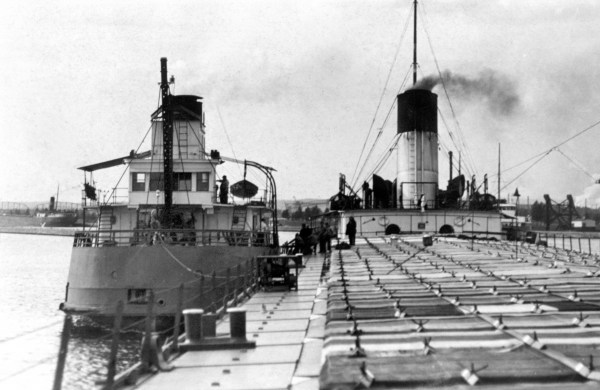

Besides the Mark W. Barker and a handful of barges, new construction for the US-flagged Great Lakes fleet has not happened in any major capacity since the late 1970s, aided by Title XI benefits from the Merchant Marine Act of 1970. Title XI offered operators guaranteed financing through the government for newbuilds and modernizing existing vessels, with additional tax benefits for investing in their fleets. This legislation is what built the current fleet of Lakers we know today. The existing fleet of Lakers has been able to handle tonnage demands since the last major newbuild program, partially aided by the steady decline of coal cargoes and the cyclical nature of the North American steel industry allowing for older, obsolete vessels to be retired. The carrying capacity (sum of all US-flagged dry bulk ships) has remained steady at about 1.5 million tons over the last decade and a half, while the Canadian fleet’s capacity has remained around the 600,000-ton mark. But the American-flag fleet here on the Lakes is aging – the average age of the American Laker fleet is 52 years old. That is over one and a half times the average life expectancy of 35 years of the ships built during the last fleet renewal program in the 1970s. To further put this into perspective, the average age of the Canadian Laker fleet is only 24 years, and the average age of the international visitors to the Lakes is 12. These ships have been modified, repaired, and modernized over the course of their lives to remain efficient traders, but even though they sail in freshwater, the age of the fleet is starting to rapidly catch up.

Operators seem to find themselves in a Catch-22 situation. The decline in coal transport demand in the region has significantly reduced the amount of cargo movement necessary in the region in the current market, leaving more vessels available to take on other cargoes. The demand does not exist in the sense of increased tonnage, but at the same time there is demand for new ships in the sense that the fleet will need replacement.

As for the operators, the combination of old age of the fleet and increased regulatory scrutiny have brought more unexpected repairs and work to attention. Just like when you hit the 100,000-mile point in your car, there are major repairs and maintenance items that have to be completed, with surprise issues that come up as well. With shipbuilding costs so high that newbuilds are out of reach, operators are forced to keep pushing their older ships longer and longer. This brings with it more work and maintenance to keep them going, as well as the added challenge of trying to repair old equipment. Lead times for parts that have to be specially manufactured or imported from overseas keep ships at the wall for several months at a time now. This kept the 1942-vintage cement carrier Alpena at the wall for the first six months of the 2025 season, and the 1973-built Integrated Tug-Barge Presque Isle during the summer of 2022 for three and a half months, just to name examples. These events have transpired when there is available cargo to move, forcing industry and operators to get creative in order to not fall behind. Every stakeholder on the Great Lakes should be aware of the increased potential of ships breaking down at critical infrastructure points, such as the Soo Locks or a loading dock. This would not only delay that vessel but accumulate delay time for other ships as well. The odds of this situation are only increasing at this point.

Uncertainties in regulatory direction have not positively added to the equation either. Environmental regulations for emissions and directions on future fuels present a moving target for operators and engineers alike. Further regulatory discrepancies between US and Canadian agencies leads to further uncertainty on the subject of ballast water treatment systems (BWTS). While existing US Lakers that do not leave the Great Lakes-St. Lawrence Seaway system are not required to have BWTS, Canada put rules in place mandating systems onboard any vessels taking on or discharging ballast in Canadian waters by the year 2030.

Building new ships is the result of an equation that combines both demand for the new tonnage, whether that be for new cargo, replacing existing tonnage, or other initiatives, in combination with the economic factors that allow for the capital investment in new hulls. It’s a chicken and the egg situation. The Great Lakes shipping industry, and American maritime as a whole, has been caught in a tricky spot where there is demand for the new hulls in terms of fleet renewal, but the economics do not play out.

The shipping business on the Lakes is a competitive trade, where margins are tight and don’t allow for large amounts of capital to be saved for investment in new hulls, especially when the old hulls are so maintenance-intensive. To top this, current market conditions make it difficult to reinvest. Competition between operators continues to evolve, where in more recent times some have been more willing to slash operating budgets in efforts to undercut rates in a race to the bottom business style. This slims margins even more, making it more difficult for everybody to look to reinvesting in new vessels. Industries that rely on cargo movement via Lakers are attracted to the low tonnage prices, and are reluctant to look past the lowest shipping rate and invest in the long-term viability of their shipping platform through commitment to long-term partnerships. There are some exceptions, however. Interlake Steamship constructed the Mark W. Barker as the result of a long-term agreement to transport salt for Cargill. US operators are often hesitant to handle salt cargoes in order to protect their aging Lakers from the corrosive nature of the cargo. Cargill realized they needed the security of having a reliable Jones Act vessel to handle their cargo, and partnered with Interlake for a long-term solution that was realized through a newbuild Laker.

Domestic US shipping is regulated by the Jones Act, which mandates that ships moving cargo between US ports be US built, owned, and crewed. The US maintains very high standards in labor regulations and construction quality, but it comes at a cost so high that domestic operators are not able to justify investment in new hulls. US shipyards come nowhere close to competing with rates on the world market. Steel and labor costs are multiples of those seen around the globe. The methods of trying to surgically maintain existing vessels only adds to those costs. Laws like the Jones Act are necessary to maintain a domestic industrial base capable of producing vessels for coastwise trading and national defense, otherwise the art of shipbuilding would be lost in America as a whole. Canada is a perfect example of this, as the repeal of the Canadian-built stipulation in the Canadian Coastwise Trading Act dealt a final death blow to the Canadian commercial shipbuilding industry, with their defense shipbuilding industry even feeling the ripple effects. Canadian operators are able to build vessels overseas at a much lower cost, which has allowed them to renew their fleets at a massive scale in recent years. The prohibitively high costs at US yards further snowball into issues relating to maintaining a skilled labor workforce capable of building high quality ships when steady work is not always coming in.

Work at Great Lakes shipyards is highly cyclical, with loads ramping up on the ships during the winter layup period, but during the summer months yards have to rely on military or off-lakes contracts to keep staff busy. When the ice and snow come in wintertime, operators look at the remaining shipyards to handle several vessels-worth of projects simultaneously, and expect them to complete them in time for fit-out in March. Then when an emergency comes up in the middle of the season the shipyards are expected to turn the ship around in a matter of days. The situation can be compared to having an auto repair shop only open regularly during three months of the year, and on-demand for the remainder of the season. When repairs are necessary during the other nine months, it won’t be at the pace of a Formula 1 pit stop. The lack of consistent commercial newbuilds locally has been to the detriment of maintaining that steady workload and skilled labor. As shipbuilding has declined in the US, the skilled workforce of welders, pipefitters, electricians, and other specialists dwindled, and now finding qualified workers is a big concern. Local yards no longer feature full-service machine shops, repair facilities, or fabricating capabilities and contract out several components to a project since they cannot support those workers full-time. Additionally, Great Lakes shipyards have historically been behind the curve when it comes to adoption and implementation of advanced shipbuilding technology and methods, further driving up costs and reducing competitiveness in broader markets.

The demand for new construction for the Jones Act Laker fleet is there, but it is a difficult target for almost every player to hit. Most new shipbuilding on the US side has been tied to long-term cargo commitments in recent years, and not as much to support existing contracts. This will have to give at some point, as the current fleet will not be able to last forever. A partial fleet renewal is likely in store at some point in the near future, with individual vessel replacement being explored for ships nearing the end of the line. Additional ship conversions to articulated tug-barge units are even more likely. The issue of financing these capital investments still remains a challenge. A full fleet renewal – such as the one seen with the Title XI subsidies and tax benefits in the 1970s – is still beyond the horizon without a change of status quo. The right combination of economic conditions may play on the side of the shippers and shipbuilders. If interest rates drop low enough to justify the payment on the debt for new tonnage in relation to the operating costs of the aging fleet, investment will be a much more attractive option for operators. If we are having the broad shipbuilding conversation, the question needs to be asked if new ships are for business expansion or retention. Major Canadian carriers like Algoma and CSL have fully renewed their fleets in recent years, but this is to preserve existing contracts, not expand into new ones. Allister Paterson, President of Canada Steamship Lines, put this into perspective in a 2015 press release about CSL’s Trillium-Class fleet renewal program.

“Great Lakes shipping is a mature market, it isn’t growing. Our Trillium program has always been about renewing our fleet, not growing it.”

While the current market is in need of new vessels to support continuing operations, other Canadian carriers such as McKeil Marine have proven that new niches can be carved out while rosters for the remainder of the fleet have turned over. Waterborne routes can be identified for more cargoes currently using land-based transportation on the American side as well.

What about the SHIPS for America Act? Great question. The SHIPS for America Act is not currently set up to have direct impact on the Great Lakes shipping industry, at least not a direct benefit. In fact, it may present further challenges in its current form. The Act does not include provisions allowing Great Lakes operators to take advantage of financing and benefits for investment in fleet renewal and modernization. Rather, it will focus on oceangoing merchant vessels and expanding the shipbuilding industrial base in order to support ramping up defense shipbuilding. This investment in the industrial base to support defense and oceangoing shipbuilding will draw workers away from the Great Lakes region and out to the major coasts, leaving labor to become even more scarce. If provisions in the Act accounted for inland transportation like the Great Lakes and Inland Waterways, the industry may be able to rebuild and set up for a more sustainable future to be able to better reliably support American manufacturing and defense. Broadly, if the SHIPS act is about maintaining what we have and expansion, that conversation needs to involve the Great Lakes, a region responsible for moving the building blocks of America. In theory, if companies were incentivized to renew their fleets and look at new business, that would stimulate the Jones Act fleet into a period of dynamic evolution. But as long as the current fleet continues sailing without real investment in renewal, operating costs and freight rates will only go up, which will trickle down through the industries down to the very cereal, appliances, automobiles, and more used by the average American. It is only a matter of time before vessels start to be sidelined due to their condition, whether it be for repairs, or worse yet, not passing regulatory inspection.

There is a long road of challenges to face to make it possible to revive the shipbuilding industry in the Great Lakes region and renew the Great Lakes fleet for a sustainable future. It will take getting creative to find ways to economically justify building new ships, and efforts from shippers to shipbuilders to the industries they serve to make this possible to rebuild for long-term sustainability. The Great Lakes was once a center for shipbuilding prowess and innovation, and can be once again with renewed investment and strategic planning.

Special thanks to Travis Martin and Fred Koller from Bay Engineering, Eric Helder from Interlake Maritime Services, Nick Hunter from NETSCo./EBDG, and Chuck Canestraight from Port City Marine Services for contributing their professional insight for this story.

Replies to this email are sent to the editor of Shipwatcher News